Summary of Facts

事實摘要

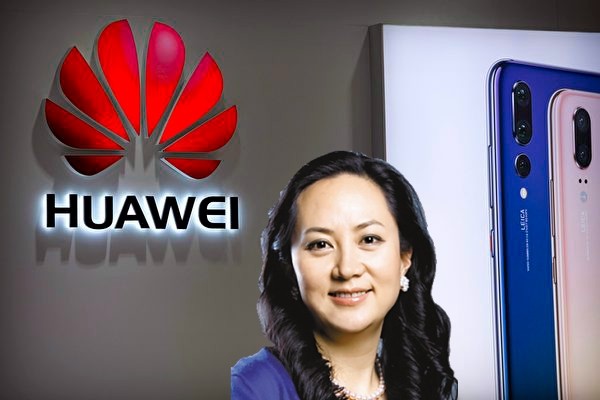

Wanzhou Meng (“Meng”), also known as “Cathy Meng” and “Sabrina Meng,” is the Chief Financial Officer (“CFO”) of Huawei Technologies Co. Ltd. (Huawei”), a corporation organized under the laws of the People’s Republic of China (“PRC”) and the world’s largest telecommunications equipment company. Meng is a citizen of the PRC and a daughter of Huawei’s founder, Ren Zhengfei. In addition to her role as CFO, Meng currently serves as Huawei’s Deputy Chairwoman of the Board, and serves or has served in various roles at other Huawei subsidiaries and affiliates. Meng also served on the board of Hong Kong-based Skycom Tech Co. Ltd. (“Skycom”) in or about and between February 2008 and April 2009. According to financial statements for Skycom for the years 2009 and 2010, the “principal activities of Skycom were engaged in [sic] investment holding and acting as a contractor for contracts undertaking [sic] in Iran.”

孟晚舟,英文名Cathy Meng或Sabrina Meng,是華為技術有限公司(以下簡稱”華為”)的首席財務官。華為依據中國的法律運營,是全球最大的電信設備提供商。孟晚舟是中國公民,其為華為創始人任正非的女兒。除了是CFO,她也是華為的副董事長。她還在多家華為子公司中擔任過或正在擔任職務。孟晚舟也曾於2008年2月至2009年4月前後,在總部位於香港的Skycom科技有限公司(以下簡稱”Skycom”)擔任過董事。Skycom 2009和2010年的財報顯示:Skycom的主要業務是投資控股並擔任與伊朗(簽訂)的合同的承包商。

According to information obtained through an investigation by U.S. authorities, including the following, Huawei operated Skycom as an unofficial subsidiary to conduct business in Iran while concealing Skycom’s link to Huawei. In this manner and as explained in further detail below, Huawei could conceal the nature of certain business it was conducting in and related to Iran, which is generally considered a high-risk jurisdiction.

根據美國當局調查所獲得的信息(以下有述):華為將Skycom作為非官方的子公司運營,以此開展在伊朗的業務,同時隱瞞了兩家公司間的聯繫。華為用這種方式隱瞞了它在伊朗境內開展的以及與伊朗有關的業務信息,而這一塊通常被認為是一個高風險管轄區。具體細節如下》

Former employees of Skycom have stated, in sum and substance, that Skycom was not distinct from Huawei. For example, Skycom employees had Huawei email addresses and badges, individuals working in Iran used different sets of stationery (“Huawei” and “Skycom”) for different business purposes, and the leadership of Skycom in Iran were Huawei employees;

根據Skycom前僱員的陳述,無論是整體還是細節,Skycom都和華為關係密切。例如,Skycom的僱員用華為的電郵地址,有華為的徽章。在伊朗工作的人員根據不同的業務需要使用不同的文具(華為和Skycom都有)。Skycom在伊朗的領導層是華為的僱員;

Documents show that multiple Skycom bank accounts were controlled by Huawei employees, and Huawei employees were signatories on these accounts between 2007 and 2013;

文件顯示,多個Skycom的銀行賬號是由華為僱員控制的,這些僱員2007-2013年間是賬戶的簽字人;

Documents and email records show that persons listed as “Managing Directors” for Skycom were Huawei employees;

文檔和電子郵件的記錄顯示:被列為”Skycom經理”的人員是華為的僱員;

Skycom official documents, including several Memoranda of Understanding, bore the Huawei logo;

Skycom的官方文件,包括幾份備忘錄,上面有Huawei的商標;

Email correspondence and other records show that all identified Skycom business was conducted using “@huawei.com” email addresses; and

電郵通信和其它記錄顯示:所有被確認的Skycom的業務使用的都是包含”@huawei.com”的電郵地址;

Documents show that a purportedly unrelated entity to which Skycom was supposedly “sold” in 2009 was actually also controlled by Huawei until at least in or about 2014.

文件顯示:據傳2009年收購了Skycom的一家先前被認為並不相關的實體事實上也是由華為控制的,直到2014年前後。

Transactional records and other documents obtained by U.S. authorities further demonstrate that Huawei operated Skycom as an unofficial subsidiary to conduct business in Iran while concealing Skycom’s link to Huawei. Among other things, records obtained through the investigation show that Skycom was used to transact telecommunications business in Iran for major Iranian-based telecommunications companies.

美國當局獲取的交易記錄和其他文件進一步顯示:華為把Skycom作為非官方的子公司來運營,目的是為了在伊朗開展業務,同時隱瞞起了Skycom與華為的關係。此外,調查的記錄顯示,Skycom被用來為伊朗主要的電信公司經營電信業務。

PROVISIONAL ARREST REQUEST FOR WANZHOU MENG

孟晚舟臨時逮捕請求書

The investigation by U.S. authorities has revealed a conspiracy between and among Meng and other Huawei representatives to misrepresent to numerous multinational financial institutions, including a global financial institution which conducts business in the United States (“Financial Institution 1”), Huawei’s business practices, particularly Huawei’s control of Skycom in or about and between 2009 and 2014. Specifically, Meng and other Huawei representatives repeatedly lied about the nature of the relationship between Huawei and Skycom and the fact that Skycom operated as Huawei’s Iran-based affiliate in order to continue to obtain banking services from multinational financial institutions.

美國當局的調查顯示:孟晚舟和其他華為代表共謀向眾多跨國金融機構做了虛假陳述,包括一家在美國開展業務的全球性金融機構(以下簡稱為:金融機構1)。虛假陳述的內容涉及華為的業務,重點是華為在2009-2014年間對Skycom的控制權。具體而言,孟晚舟和其他華為代表在華為和Skycom關係的實質上反覆撒謊,隱瞞了Skycom作為華為在伊朗的附屬公司運營的事實,這些行為的目的是為了從跨國金融機構處繼續獲得銀行服務。

The motivation for these misrepresentations stemmed from Huawei’s need to move money out of countries that are subject to U.S. or E.U. sanctions – such as Iran, Syria, or Sudan – through the international banking system. At various times, both the U.S. and E.U. legal regimes have imposed sanctions that prohibit the provision of U.S. or E.U. services to Iran, such as banking services. Of particular relevance, companies such as Huawei operating in sanctioned countries often need to repatriate income out of those countries by relying on U.S.-dollar clearing transactions, which typically pass through the United States, or Euro-clearing transactions, which typically pass through E.U. countries. Huawei was a customer of Financial Institution 1 and the other victim institutions, and conducted a significant amount of its international banking activity, including U.S.-dollar-clearing transactions, with Financial Institution 1. The financial institutions at issue, including Financial Institution 1, maintained policies by which they would not onboard Iran-based clients or process Iran-related transactions through the United States, so as to avoid exposure to U.S. civil and criminal liability. In response to due diligence inquiries by the banks regarding these internal policies, Meng and other Huawei representatives repeated stated that Huawei did not operate Skycom and that, with respect to Financial Institution 1, Huawei would not use Financial Institution 1 to process any Iran-related transactions.

這些虛假陳訴的動機源於華為需要通過國際銀行系統將資金從受美國或歐盟製裁的國家(如伊朗、敘利亞或蘇丹)轉移出去。美國和歐盟的法律體系多次實施製裁,禁止向伊朗提供美歐的服務(如銀行服務)。尤其需要注意的是,華為這樣在受製裁國家開展業務的公司經常需要依靠美元結算交易(通常通過美國)或歐元結算交易(通常通過歐盟國家),從受製裁國家轉回收入。華為曾是金融機構1和其他受害機構的客戶。華為與金融機構1進行了大量的國際銀行業務,包括美元結算交易。涉及的包括金融機構1在內的金融機構都有相關政策,不與總部在伊朗的客戶進行交易,也不通過美國處理與伊朗相關的交易,以免承擔美國的民事或刑事責任。針對銀行就這些內部政策進行的盡職調查,孟晚舟和其他華為代表反覆表示:華為不控股Skycom,也不會利用金融機構1來處理任何與伊朗相關的交易。

Because Meng and other Huawei representatives misrepresented to Financial Institution 1 and the other financial institutions about Huawei’s relationship with Skycom, these victim banking institutions were induced into carrying out transactions that they otherwise would not have completed. As a result, they violated the banks’ internal policies, potentially violated U.S. sanctions laws, and exposed the banks to the risk of fines and forfeiture. In particular, these relationships included the clearing of hundreds of millions of U.S.-dollar transactions through correspondent accounts at financial institutions in Eurozone countries. In essence, these misrepresentations exposed the financial institutions to serious harm and denied the institutions the opportunity to make decisions based on the true risk of processing certain transaction and the reputations risk associated with banking high-risk clients such as Huawei.

因為孟晚舟和其他華為代表向金融機構1和其他金融機構虛假陳述了華為與Skycom的關係,這些受害的銀行機構被誘使進行了原本不會發生的交易。結果,它們違反了銀行的內部政策,並有可能因此違反了美國的製裁法案,面臨著罰款和被吊銷資格的風險。注意,華為與Skycom的關係包括通過歐元區國家金融機構的往來賬戶結算了數億美元的交易。實質上,這些虛假陳述使金融機構面臨著巨大的危險,使它們無法判斷出進行某些交易的真實風險,並根據這些真實風險做出判斷,也使他們無法判斷與華為這樣的銀行高風險客戶進行交易所冒的聲譽風險。

For example, during the relevant timeframe, Financial Institution 1 was under investigation for U.S. sanctions violations involving Iran and later entered into a deferred prosecution agreement pertaining to U.S. sanctions violations involving Iran, and could therefore have suffered criminal consequences for processing Huawei’s Iran-based transactions.

例如,在相關時限內,金融機構1正因為違反了美國對伊朗的製裁(法案)而接受調查,之後達成了延遲起訴協議,並可能因為違反了上述法案(處理了華為在伊朗的交易)而面臨著刑事處罰。

Relying on the misrepresentations by Meng and other Huawei representatives, Financial Institution 1 and its U.S. subsidiary cleared more than $100 million worth of transactions related to Skycom through the United States between approximately 2010 and 2014.

根據孟晚舟和其他華為代表所做的虛假陳述,金融機構1及其美國的子公司在2010-2014年前後通過美國結算了超過1億美元與Skycom相關的交易。

Many of the misrepresentations at issue were in direct response to a series of articles published by Reuters describing how Huawei controlled Skycom, and alleging that Skycom had attempted to import U.S.-manufactured computer equipment into Iran in violation of U.S. sanctions. One of the Reuters articles reported that Meng was a member of the board of directors of Skycom for several years. In statements reported in those Reuters articles, Huawei denied control of Skycom or violations of law.

許多相關的虛假陳述都是直接回應路透社發表的一系列描述華為如何控股Skycom的文章。這些文章還指出,Skycom試圖違反美國的製裁法案,將美國製造的電腦設備進口到伊朗。一篇路透社的文章報道說,孟晚舟擔任Skycom的董事會成員已經數年。華為針對這些文章發表的聲明中否認了控股Skycom和違反法律。

According to information obtained from international financial institutions that conducted business with Huawei, after the Reuters articles were published, several of them, including Financial Institution 1, asked Huawei whether the allegations regarding their control of Skycom and business with Iran made in the Reuters articles were true. In response to those questions, Huawei employees and executives made a series of misrepresentations, both publicly and in private communications, with various banking executives, among other things, denying Huawei’s control of Skycom and claiming Huawei did not violate U.S. sanctions law.

根據與華為開展業務的國際金融機構的信息,路透社的文章發表以後,包括金融機構1在內的數家機構都詢問了華為:路透社文章中提及的關於控股Skycom和與伊朗開展業務的指控是否屬實。作為對問題的回應,華為的僱員和高管們在公開場合以及私下溝通中都對銀行高管做了一系列的不實陳述,重點否認了華為控股Skycom,並宣稱華為沒有違反美國的製裁法。

For example, after the Reuters articles were published, Financial Institution 1 requested that Huawei provide further information and clarification regarding the relationship of Huawei and Skycom. Although those inquiries were not addressed to Meng, on or about August 2013, Meng arranged for a meeting with an executive of Financial Institution 1, and during that meeting, made a number of misrepresentations to an executive of Financial Institution 1.

例如,路透社的文章發表以後,金融機構1要求華為就其與Skycom的關係提供進一步的信息,並作出澄清。儘管在2013年8月前後,這些詢問並不是針對孟晚舟本人的,但她安排了一次與金融機構1高管的會面。這次會面中,她對金融機構1的這位高管做了一些虛假陳述。

會面中,孟晚舟安排了一名英語口譯員,介紹方式是PPT推介。孟晚舟表示,用口譯員是為了更確切地描述自己的意思。會議之後,金融機構1的一位高管希望能得到孟晚舟所用PPT的英文版本。孟晚舟親自安排在2013年9月3日前後把這份文件遞交給了金融機構1。這份PPT包含了大量虛假或誤導性的陳述,內容涉及華為對Skycom的所有權、控制權以及華為是否遵守了美國的相關法律。例如:

Meng stated that “Huawei operates in Iran in strict compliance with applicable laws, regulations and sanctions of UN, US and EU,” although Skycom was using the U.S. financial system to conduct prohibited Iran-related transactions;

孟晚舟說:”華為在伊朗的運營嚴格遵守了相關法律法規以及聯合國、美國、歐盟的製裁法案”。儘管事實上Skycom利用美國金融系統進行了嚴令禁止的與伊朗的交易行為。

Meng stated that “Huawei’s engagement with Skycom is normal business cooperation. Through its trade compliance organization and process, Huawei requires Skycom to make commitments on observing applicable laws, regulations and export control requirements.” However, as discussed above, Huawei did not “cooperate” with Skycom; Skycom was entirely controlled by Huawei;

孟晚舟說:”華為與Skycom進行的是普通的業務合作。華為通過合規的貿易機構和程序,要求Skycom做出承諾,遵守相關法律、法規和出口管制要求。”然而,如前文所述:華為不是和Skycom”合作”,華為完全控制著Skycom;

Meng Stated that “Huawei was once a shareholder of Skycom, and I [Meng] was once a member of Skycom’s Board of Directors. Holding shares and a BOD position was meant to better manage our partner and help Skycom to better comply with relevant managerial requirements.” However, as discussed above, there were no “Skycom” employees who were managed by Huawei; Skycom employees were Huawei employees;

孟晚舟說:”華為曾經是Skycom的股東,我(指孟本人)曾經是Skycom的董事會成員。持股和進入董事會都是為了更好地管理我們的合作夥伴,幫助Skycom更好地遵守相關的管理規定。”然而,如前文所述:Skycom沒有僱員是接受華為管理的,Skycom的僱員就是華為的僱員;

Meng stated that “As there was no process or organization at Skycom, Board supervision was the only way to ensure trade compliance. Holding shares or assigning Board member could help Huawei to better understand Skycom’s financial results and business performance, and to strengthen and monitor Skycom’s compliance.” As discussed above, even while Meng was on the Board, Huawei did not “monitor” Skycom’s compliance – Skycom’s “employees” were effectively Huawei employees who used Huawei email addresses.

孟晚舟說:”由於Skycom沒有(完善的)流程和組織,所以董事會的監督是唯一保證其貿易合規的方法。持股和指派董事會成員可以幫助華為更好地了解Skycom的財務業績和經營表現,並加強和監督Skycom的合規性。”如前文所述,即使是在孟晚舟擔任董事期間,華為也沒有”監督”Skycom的合規性——Skycom的”僱員”實際上都是使用華為電郵地址的華為員工。

Meng stated that “Huawei has sold all its shares in Skycom, and I [Meng] also quit my position on the Skycom Board.” As discussed, that statement was highly misleading because Huawei sold its shares in Skycom to a company also controlled by Huawei.

孟晚舟說:”華為已經賣掉了其在Skycom的所有股份,我[孟晚舟]也辭去了董事職位。”如前文所述,這個聲明極其誤導,因為華為將其在Skycom的股份賣給了一家同樣由華為控制的公司。

Not only did Meng give this presentation herself, but both the written presentation and her oral statements to the executive of Financial Institution 1 refer to Meng in the first person, using the word “I”, indicating Meng’s personal knowledge of the facts surrounding her statements.

孟晚舟不僅本人做出了相關陳述,而且在書面以及對金融機構1高管的口頭陳述中,都使用了第一人稱”我”,這表明她本人知曉有關這些陳述的事實情況。

Following Meng’s presentation, several Financial Institution 1 risk committees relied in part upon Meng’s representations to continue banking Huawei. For example:

在孟晚舟做出相關陳述後,金融機構1的幾個風險委員會部分基於她的虛假陳述,決定繼續開展和華為的銀行業務。例如:

A briefing paper from in or about November 2013 stated, “Huawei confirms that Skycom is a business partner of Huawei and works with Huawei in sales and services in Iran.” The minutes for the meeting reflect, “Huawei advised [Financial Institution 1] that its shareholding in Skycom was sold in 2009 and that Cathy Meng (CFO Huawei) resigned her position on the board of Skycom in April 2009 … [T]he committee agreed to RETAIN the relationship with Huawei …”

2013年11月前後的一份簡報稱:”華為證實了Skycom是其商業夥伴,並與華為在伊朗有銷售和服務上的合作。”會議紀要顯示:”華為告知(金融機構1)其在Skycom的股份已於2009年售出,孟晚舟也已於2009年4月辭去了Skycom的董事職務。委員會同意維持與華為的(合作)關係。”

Similar statements are in risk committee briefings from in or about February 2014 and March 2014. All of the committees relied on Meng’s statements, and none of these committees took adverse action related to the Huawei relationship with Financial Institution 1.

2014年2-3月前後,風險委員會的簡報中也有類似的聲明。所有委員會都採信了孟晚舟的聲明,沒有一家委員會就華為與金融機構1的合作關係採取了不利於華為的行動。

An executive at Financial Institution 1 stated that Financial Institution 1’s risk committee decided to retain Huawei as a client because “Huawei sold Skycom and the Huawei Chief Financial Officer (CFO) was no longer on the Skycom board.” The executive further said that, had Huawei not actually sold Skycom, such a fact would have been “material” to deciding to exit the client relationship.

金融機構1的一位高管表示:金融機構1的風險委員會決定和華為維持合作關係,是因為”華為出售了Skycom的股份,而且華為的首席財務官也不再擔任Skycom的董事。”這位高管補充道:如果華為事實上沒有把Skycom賣掉,這件事情足以讓其所在機構與華為的合作關係畫上休止符。

On or about April 15, 2015, a Financial Institution 1 reputational risk committee met in New York City to discuss whether to begin providing banking services to a Huawei U.S. subsidiary. Meng’s statement about Huawei’s sale of Skycom was presented to that committee, along with other information. The committee declined to provide banking services to the Huawei U.S. subsidiary.

2015年4月15日前後,金融機構1的聲譽風險委員會在紐約召開會議,討論是否向華為在美國的一家子公司提供銀行服務。會議上有人把孟晚舟關於華為出售Skycom的聲明以及其他一些信息提交給了委員會。該委員會拒絕向華為的美國子公司提供銀行服務。

The misrepresentations personally made by Meng were part of a broader conspiracy to misrepresent the relationship between Huawei and Skycom. Other Huawei employees and representatives made similar misrepresentations to Financial Institution 1 and to at least three other global financial institutions. For example, a reputational risk report from one of those financial institutions states that “Huawei has stated that Skycom is a HK [Hong Kong] local business partner and has no further affiliation with Huawei.” Some of these misrepresentations were made, involved, or resulted in interstate and foreign wire transmissions.

孟晚舟個人的虛假陳述只是共謀捏造華為與Skycom關係的一部分。其他華為僱員和代表也對金融機構1及至少三家不同的國際金融機構做出了類似的虛假陳述。例如,來自其中一家金融機構的聲譽風險報告指出:華為表示Skycom是一個香港本地的業務夥伴,與華為沒有更進一步的聯繫。一些虛假陳述在(美國)國內和國外都有散布。

IDENTIFICATION

身份

Wanzhou Meng is a citizen of the People’s Republic of China born on February 13, 1972. She is believed to reside in China. She is traveling to Vancouver, Canada on Saturday, December 1, 2018, on Cathay Pacific (CX) Flight 838, in transit to a third country, believed to be Mexico. She is scheduled to arrive at Vancouver International Airport at approximately 11:30 AM, PST. Meng will be traveling on a Hong Kong passport bearing passport number KJ0403962. The photograph attached to the Request for Provisional Arrest was obtained from a publicly available website for HUAWEI TECHNOLOGIES CO. LTD, which represents the person depicted as Ms. Wanzhou Meng (Sabrina Meng), the Deputy Chairwoman, and CFO.

孟晚舟是中華人民共和國公民,出生於1972年2月13日,據信居住於中國。她將於2018年12月1日(周六)乘坐國泰838航班抵達加拿大溫和華,轉機飛往第三國(據信是墨西哥)。預計她抵達溫哥華國際機場的時間在太平洋標準時間上午11:30。孟晚舟持有的是香港護照,護照號碼為KJ0403962。附在臨時逮捕請求上的照片是從華為技術有限公司公開的網站上獲取的,網站稱她為孟晚舟(Sabrina Meng)女士,擔任華為的副董事長及首席財務官。

BASIS FOR URGENCY

事件緊急

The United States first obtained information regarding Meng’s travel to Canada on November 29, 2018. U.S. authorities believe, based on the totality of circumstances, that unless Meng is provisionally arrested in Canada on Saturday, December 1, 2018, while in transit, it will be extremely difficult, if not impossible, to secure her presence in the United States for prosecution. The United States has no extradition treaty with the People’s Republic of China, and Meng, who is the CFO of one of China’s major corporate entities and the daughter of its founder, has significant assets at her disposal. She has the ability to travel and remain outside of the United States indefinitely.

美國最早於2018年11月29日獲得了孟晚舟將飛往加拿大的信息。美國當局相信,綜合各方信息判斷,除非孟晚舟 2018年12月1日在加拿大轉機時被臨時逮捕,否則基本不可能有逮捕她、保證她在美國被起訴的機會。美國和中國沒有引渡條約,而孟晚舟作為中國主要實體企業之一(華為)的首席財務官及創始人之女,擁有很多資源。她有無限期逗留在美國國境外的能力。

U.S. authorities believe that after in or about April 2017, Huawei became aware of a U.S. criminal investigation of Huawei when Huawei’s U.S. subsidiaries were served with a grand jury subpoena commanding production of, among other materials, all records of Huawei’s Iran-based business. As a result, Huawei executives began altering their travel patterns, to avoid any travel to or through the United States. Specifically, high-level Huawei executives, including Meng, have ceased traveling to the United States. Although Meng previously traveled to the United States multiple times in 2014, 2015, and 2016, her last trip to the United States was from late February through early March 2017. Meng has not come the United States since then. Moreover, another senior Huawei executive came to the United States at least four times between 2013 and 2016, and has not traveled to the United States since then.

美國當局相信:大約在2017年4月之後,華為覺察到了美國對華為進行的刑事調查。當時華為在美國的子公司接到了大陪審團的傳票,要求了解和華為在伊朗業務有關的所有生產及各方面信息。從那時起,華為的高管就開始改變行程,不再途徑美國。尤其是包括孟晚舟在內的華為最高層,完全終止了赴美行程。2014-2016年,孟晚舟多次赴美。2017年2月末至3月初,她最後一次赴美。之後,孟就沒有到訪過美國。此外,另一位華為高管2013-2016年間至少4次赴美,但那之後也沒有到訪過美國。

—————————–

原文(圖片)參閱地址:

https://zh.scribd.com/document/395187937/Court-documents-for-Wanzhou-Cathy-Meng

——林中虎博客

—————————–

──轉自《新世紀》本文只代表作者的觀點和陳述。

(責任編輯:劉明湘)